lv fixed term annuity death benefits | 5 year fixed term annuity lv fixed term annuity death benefits Find out more about retirement and pension types and options from LV=, including the death benefits included as part of our Protected Retirement Plan.

Get up to speed with everything you need to know about the 2023 Las Vegas Grand Prix, which takes place over 50 laps of the 6.2-kilometre Las Vegas Strip Circuit in Nevada, USA, on Saturday, November 18.

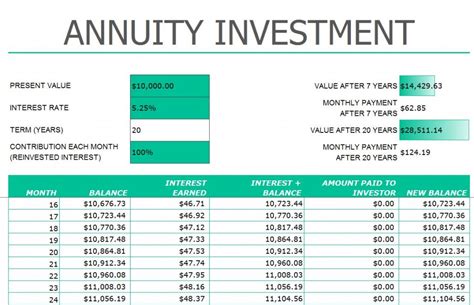

0 · fixed term annuity calculator

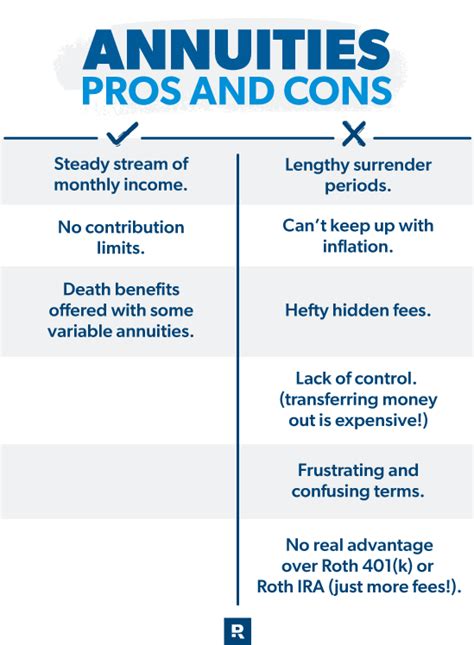

1 · fixed rate annuity pros and cons

2 · fixed annuity pros and cons

3 · fixed annuity pros

4 · Lv fixed term annuity calculator

5 · Lv annuity log in

6 · 5 year fixed term annuity

7 · 10 year fixed term annuity

1. Check The Stitching. If you’re wondering how to tell if a Louis Vuitton bag is real, start by checking the stitching. The number of stitches, the quality thereof, the alignment, and the color of the stitches can all indicate if it’s the real deal or a fake bag.

Fixed term annuities give you a guaranteed income for a fixed period of time while knowing how much money you'll be left with at the end. You can protect your income by taking out a death .Fixed income each month? Yes. You can choose to receive an income either monthly, quart.Find out more about retirement and pension types and options from LV=, including the death benefits included as part of our Protected Retirement Plan.Our Fixed Term Annuity, the LV= Protected Retirement Plan offers your client more flexibility and access to their money than a standard annuity. The guaranteed income option is for a fixed .

Fixed term annuities give you a guaranteed income for a fixed period of time while knowing how much money you'll be left with at the end. You can protect your income by taking out a death benefit, which continues to pay an income to your partner .Find out more about retirement and pension types and options from LV=, including the death benefits included as part of our Protected Retirement Plan.Our Fixed Term Annuity, the LV= Protected Retirement Plan offers your client more flexibility and access to their money than a standard annuity. The guaranteed income option is for a fixed term and can be cashed in at any time.If you die, normally your annuity payments will stop and the pension fund used to buy your annuity will be lost. However there are a number of options you can take to ensure a beneficiary can still benefit from your pension savings or annuity income.

If your client is worried about dying before the end of their Trustee Investment Plan, they can choose an optional death benefit at the start of their plan. Trustees can choose one of the following options: Value protection – your client can protect up to 100% of their original investment if they pass away within the plan term. The lump sum .You could keep the rest of your pension fund invested, which means it may continue to grow while you get an income from your annuity. You have the option to add on death benefits and increase income in line with inflation to keep up with increasing costs.Guaranteed income over a fixed term, up to 25 years. Choose from a variety of death benefits, including beneficiary's income. Flexible remuneration options.

An annuity's death benefit is what gets paid out to beneficiaries when the annuitant dies. You can sometimes upgrade a death benefit for an extra cost.If you die during the chosen term, your plan will end and no further income or lump sum will be paid unless you add death benefits for income and guaranteed maturity value protection when buying our fixed term annuity.You can take a single life annuity, or a joint life annuity that will continue to pay your spouse when you pass away. There are in-built death benefits with a choice of options. You can take income on a level basis throughout the term, or rising at a fixed percentage or in line with the Retail Price Index each year.

Fixed term annuities give you a guaranteed income for a fixed period of time while knowing how much money you'll be left with at the end. You can protect your income by taking out a death benefit, which continues to pay an income to your partner .Find out more about retirement and pension types and options from LV=, including the death benefits included as part of our Protected Retirement Plan.Our Fixed Term Annuity, the LV= Protected Retirement Plan offers your client more flexibility and access to their money than a standard annuity. The guaranteed income option is for a fixed term and can be cashed in at any time.If you die, normally your annuity payments will stop and the pension fund used to buy your annuity will be lost. However there are a number of options you can take to ensure a beneficiary can still benefit from your pension savings or annuity income.

fixed term annuity calculator

If your client is worried about dying before the end of their Trustee Investment Plan, they can choose an optional death benefit at the start of their plan. Trustees can choose one of the following options: Value protection – your client can protect up to 100% of their original investment if they pass away within the plan term. The lump sum .You could keep the rest of your pension fund invested, which means it may continue to grow while you get an income from your annuity. You have the option to add on death benefits and increase income in line with inflation to keep up with increasing costs.Guaranteed income over a fixed term, up to 25 years. Choose from a variety of death benefits, including beneficiary's income. Flexible remuneration options.An annuity's death benefit is what gets paid out to beneficiaries when the annuitant dies. You can sometimes upgrade a death benefit for an extra cost.

If you die during the chosen term, your plan will end and no further income or lump sum will be paid unless you add death benefits for income and guaranteed maturity value protection when buying our fixed term annuity.

apple watch gucci strap

fixed rate annuity pros and cons

You can track your tenants’ electricity usage, create custom reports and even share real-time usage information with your tenants. The Eyedro home electricity monitor, model EHEM1-LV, is perfect for monitoring electricity consumption in almost any size home.

lv fixed term annuity death benefits|5 year fixed term annuity